Padel, a dynamic racquet sport blending elements of tennis and squash, has experienced explosive growth in the UK. With nearly 900 courts and over 400,000 players nationwide as of 2024, the sport is rapidly embedding itself in the British sporting landscape. Greater Manchester, as a major metropolitan region, offers a revealing case study of how padel’s expansion reflects broader trends in affluence, accessibility, and community engagement.

Current State of Padel in Greater Manchester

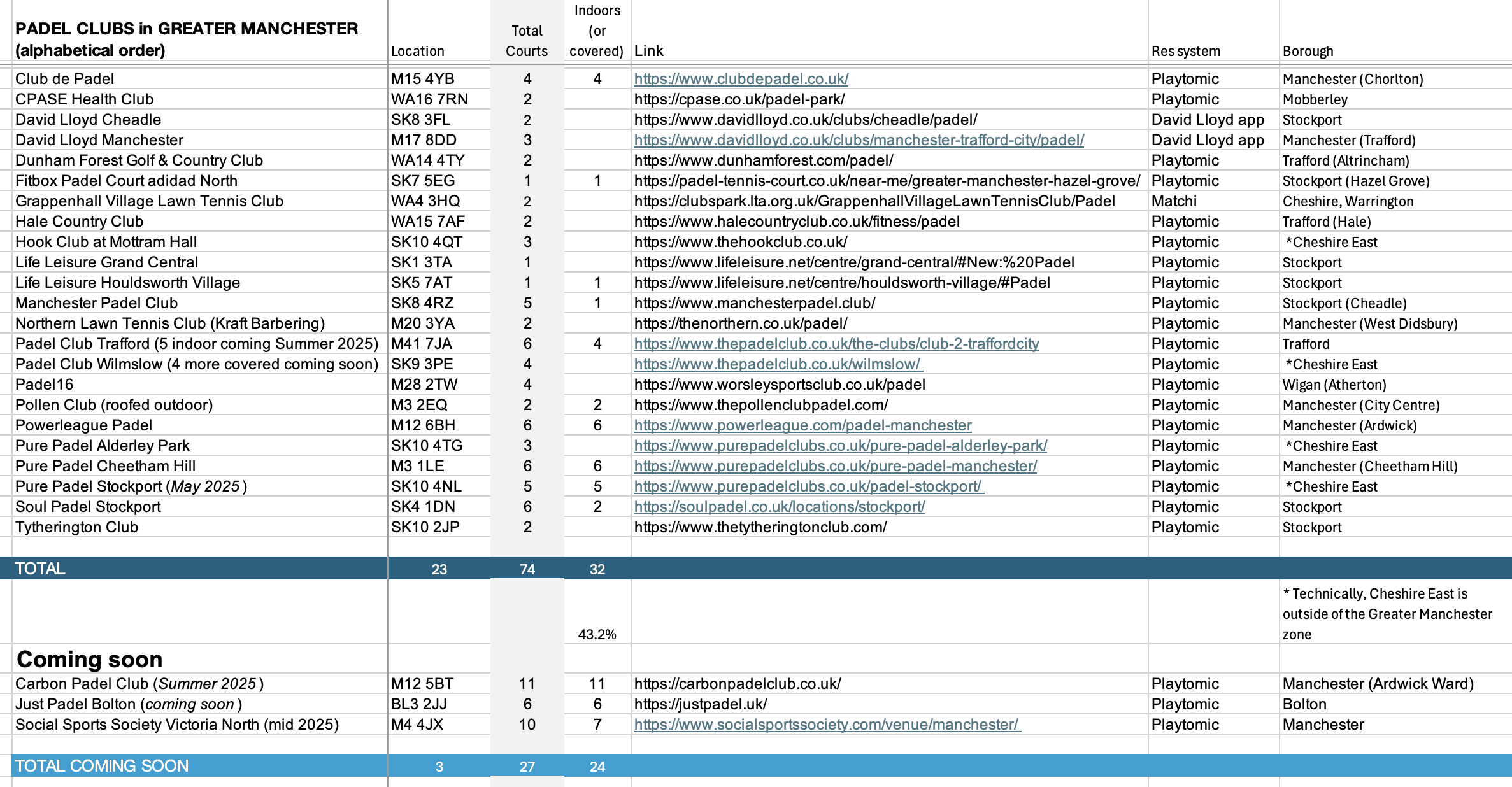

Greater Manchester currently boasts 74 padel courts across 23 venues, with plans for an additional 27 courts at three new sites by autumn 2025. This will bring the total to over 100 courts, 59% of which are indoor or covered, reflecting the region’s adaptation to local weather and outpacing London’s 44% indoor rate. The city of Manchester leads with 23 courts, followed by Stockport (18) and Trafford (10). However, several boroughs—including Bolton, Oldham, Rochdale, Bury, Salford, and Tameside—still lack any padel facilities, highlighting significant gaps in accessibility.

Socioeconomic Patterns and Accessibility

Padel court density correlates strongly with affluence. Stockport and Trafford, two of the region’s most prosperous boroughs, have the highest court-per-capita ratios, though these still lag behind London’s most saturated areas and far behind Madrid’s 33 courts per 100,000 residents. Major facilities are concentrated in affluent neighbourhoods such as Cheadle, Bramhall, Hale, and Altrincham, reinforcing a pattern seen nationwide: padel venues are 6.5 times more prevalent in affluent areas than in deprived ones.

The “Padel Desert”

Over 1.3 million residents in the boroughs of Bolton, Salford, Oldham, Rochdale, and Bury lack any local padel courts. This “padel desert” underscores the need for targeted investment and community-focused development to ensure the sport’s inclusivity and long-term growth.

Comparisons with London and National Trends

While Greater London has more courts overall (166), its court density per capita is lower than Greater Manchester’s (1.69 vs. 2.34 per 100,000 residents). Nationally, the UK is now the fifth largest padel market globally by games played and is recognised as the most social padel nation due to its high rate of open matches. Yet, as mentioned above with the penetration of courts per pop in Madrid, the growth in the number of courts in the UK has a long runway before satisfying a growing demand.

Future Growth and Opportunities

Alongside Bristol as the padel hub in the southwest, Manchester is set to further cement its status as a hub in the northwest with the opening later this year of the a large facility in the Victoria North area, featuring 10 courts. The LTA, having invested £6 million in facility development, aims to reach 1,000 courts nationwide by 2026 and is launching initiatives to broaden participation, especially among youth and in underserved communities. If the LTA (UK councils and investors) were to be serious about padel, could we not see the number of courts eclipse 5000 by the end of the decade? When you see Italy at over 9,000 courts and Sweden over 5,000, the UK certainly has a long way to go.

Conclusion

In any event, padel’s rapid ascent in Greater Manchester mirrors national trends but shows at once the potential for more growth and also exposes persistent inequalities in access. For the sport to fulfill its potential as a community asset, strategic public and private investment is needed to extend facilities into less affluent areas. Only then can padel move beyond its elite image and thrive across all of Greater Manchester.

PS Banner artwork created by OpenArt AI.